As a merchant, you may find two seemingly similar terms confusing: payment gateway vs payment processor. While they both play vital roles in managing online transactions and accepting mobile, debit card, and credit card payments, there are important differences between payment processors and gateways. Understanding the distinctions helps merchants streamline the checkout process, avoid hiccups during transactions, and improve operational efficiency.

Below, we’ll cover the definitions and mechanisms of both components in the payment processing flow, how they work together, and give a comprehensive comparison of payment processor vs payment gateway.

- What is a payment gateway and how does it work?

- When to use a payment gateway?

- What is a payment processor and how does it work?

- When to use a payment processor?

- Payment gateway vs payment processor: Comparison table

- How do payment processors and payment gateways work together?

- What do I need: A payment gateway, a payment processor, or both?

What is a payment gateway and how does it work?

A payment gateway allows online and in-store merchants to collect the customer’s payment information, encrypt it, and securely send it to the card processor for authorization.

During online checkout processes, the payment gateway acts as the online payment portal. Meanwhile, during in-person transactions, it includes card readers and POS terminals to accept card payments, i.e. credit cards and debit cards, and card-not-present (CNP) payments such as digital wallet, QR code, or Near Field Communication (NFC) payments.

Here’s how the payment gateway works:

- Collect payment information when customers tap their card or enter their card details at the online or in-person POS

- Encrypt the payment details

- Transfer the encrypted payment information to the payment processor for authorization

- Transmit the authorization response from the payment processor back to the business, notifying them if the transaction is successful

While there’s a wide range of options, the best payment gateway companies include:

Payment gateway | Location | Processing fee | Monthly fee | Best use cases |

Stripe | Online, in-person | Standard: 2.9% + 30¢ per domestic transaction Additional fees:

| No monthly fees | Omnichannel businesses |

Authorize.net | Online, in-person |

| $25 per month | Small businesses |

Worldpay | Online, in-person | 1.5% per transaction for Visa and Mastercard card transactions | £19.95 per month for online gateway | Global businesses with multi-currency needs |

Amazon Pay | Online |

| No monthly fees | Online businesses based in the U.S. |

Payflow (PayPal’s payment gateway) | Online | 10¢ per transaction |

| Online store that needs to accept international payments |

When to use a payment gateway?

If your business accepts credit cards or direct payments, especially online payments, you’ll need payment gateways to safeguard sensitive customer information during transactions.

When to use a payment gateway | When NOT to use a payment gateway |

For online businesses, which face more security risks, an eCommerce payment gateway works like a secure POS system for offline transactions. It acts as a "gatekeeper" to authenticate credit card details that customers enter during checkout. | Your POS system already includes a credit card processor and gateway credit card processing services. |

For businesses that want to accept in-store payments but have yet to invest in a full POS system, a payment gateway offers a simpler solution to process payments. | Your business has a branded app with built-in payment functions. |

For subscription-based businesses, payment gateways are essential to automate recurring payment collection and prevent failed payments. |

If you need a budget-friendly payment gateway, you can consider the best online payment gateways for small businesses including Adyen, Stax, and Payment Depot. Please note that currently, there’s no free payment gateway on the market.

FYI, there are two types of payment gateways:

- Third-party payment gateways: These send customers to an external gateway during website checkout, meaning a customer submits their card information outside of the merchant’s website. Upon transaction completion, this type of gateway takes customers back to the merchant’s website.

- Integrated payment gateways or white-label payment gateways: These gateways are built into the merchant’s eCommerce platform, so customers submit their card information and process their transactions on the merchant’s website.

What is a payment processor and how does it work?

A payment processor allows merchants to accept and handle financial transactions via credit cards, debit cards, and bank accounts.

In the transaction flow, the payment processor acts as the middleman between the customer’s bank (the card issuer) and the merchant bank (the acquiring bank).

Specifically, payment processors:

- Receive transaction details from payment gateways and validate them

- Transfer transaction data to the acquirer

- Receive authorization responses and send them to payment gateways

- Settle authorized transactions

- Provide reports for payment reconciliation

The best payment processors include:

Payment processor | Location | Processing fee | Monthly fee | Best use cases |

Helcim | Online, in-person |

| No monthly fees | Seasonal businesses and startups |

Square | Online, in-person |

| No monthly fees | Businesses in the retail sector |

Elavon | Online, in-person |

| Online: From £0 to £25 per month In-person: From £0 to £62 per month | Global businesses |

Merchant One | Online, in-person |

| Custom, from $13.95 per month | Small businesses with a tight budget requiring 24/7 support |

Clover | Online, in-person |

| From $14.95 to $89.95 per month | F&B businesses |

When to use a payment processor?

As a merchant, you should know specific cases where a payment processor is mandatory:

- Businesses of any size that accept electronic payments, credit or debit card transactions, e-wallets, and bank transfer

- Global businesses that accept international payments and need to simplify handling diverse currencies and multiple payment methods

- High-traffic businesses that want to secure large volumes of payments, automate tasks like authorization, reconciliation, and reporting, and minimize manual errors

- Omnichannel businesses that want to deliver a consistent and secure payment experience across all channels

Furthermore, you should also know whether to use a payment processor built into a POS system or a third-party payment processor.

If you prioritize convenience of an all-in-one solution and are willing to pay slightly higher transaction fees, you can utilize a built-in payment processor. In that case, make sure you understand the fee structure, hidden fees, and binding contracts.

On the other hand, if you want to ensure flexibility and cost-effective payment handling, you should opt for a third-party payment processor. Some POS systems, such as POS for Magento and POS for Shopify, offer a wide range of integration with popular payment processors like PayPal, Stripe, Square, Clover, etc.

Payment gateway vs payment processor: Comparison table

Although a payment processor vs gateway may seem similar, they play different yet complementary roles in the transaction process.

On the one hand, a payment gateway is responsible for the collection, encryption, and verification of customer payment information. This is especially important during electronic payments because online payment fraud reached $41 billion in 2022 and is forecast to double between 2023 and 2027. An Internet payment gateway helps merchants verify mobile payment, debit card, and credit card information while completing digital transactions.

On the other hand, payment processors take charge of payment data validation and transmission, and fund settlement. They also offer additional services like fraud detection and prevention, chargeback management, and reconciliation reporting. Without them, merchants can’t request and receive payment from the customer’s account.

The table below summarizes key distinctions between a payment gateway vs payment processor.

Payment gateway | Payment processor | |

Role in the transaction process | Collect, encrypt, and verify payment information | Process and authorize payments, secure the fund transfer |

Intermediary between the business and the customer | Intermediary between the business, the customer bank, and the merchant bank | |

Usage | Must integrate with a payment processor | May work as a stand-alone service |

Scope of services | Focus on securely transmitting payment data and don’t inherently possess advanced fraud detection capabilities | Offer a range of services, including transaction processing, fraud detection, chargeback management, and compliance with payment regulations |

Integration with business systems | Provide easy payment gateway integration through APIs with business systems such as eCommerce platforms, accounting, CRM software to streamline business operations | Provide payment integrations with other business workflows such as CRM, accounting, and billing.

Require complex setup procedures and a merchant account to process transactions

|

Best for | eCommerce payments, card-not-present transactions, subscription-based services, and businesses without a full POS system | Overseas transactions, businesses using a POS system, omnichannel retailers, and high-volume merchants |

How do payment processors and payment gateways work together?

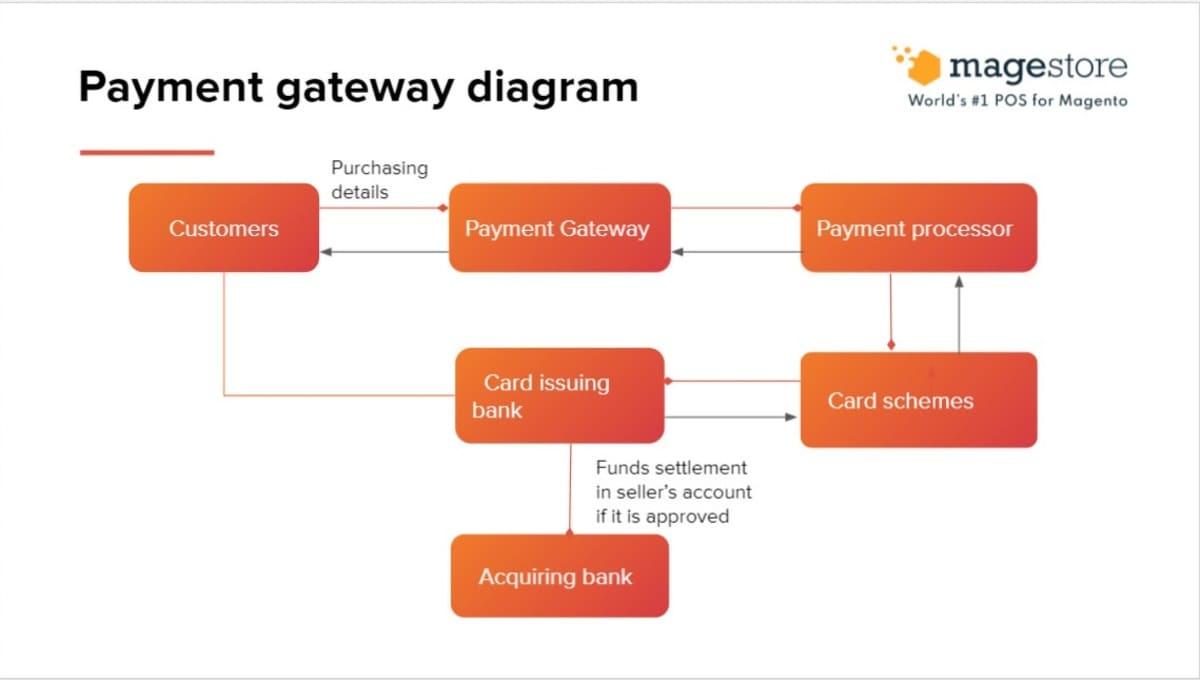

Payment processors vs payment gateways have different functions in the payment processing flow. The two components work together to facilitate smooth communication and safe data transfer between merchants, customers, and banks.

Here’s how a payment gateway vs processor collaborates during a transaction:

- First, the customer starts a transaction by giving the business their payment information.

- Second, the payment gateway receives the transaction information from the checkout page, encrypts it, and sends it to the payment processor.

- The payment processor then forwards it to the card issuing bank (the customer bank) to request payment authorization for the transaction.

- The issuing bank verifies the payment details, checks for available funds, and then either approves or declines the transaction. After that, it transmits this approval or decline message to the payment processor.

- Next, the payment processor shares the authorization response from the issuing bank to the payment gateway.

- The payment gateway sends the response back to the business, which displays the “transaction approved” or “transaction declined” message to the customer.

- If the transaction is approved, the payment processor coordinates the fund transfer from the customer bank to the business bank account. This process, called payment settlement, typically takes a few business days to complete.

- Finally, the payment processor provides reports for the business to reconcile transactions.

The collaboration of the payment gateway and payment processor helps businesses handle sensitive payment information securely and efficiently. The two components working together also ensure that the payment process adheres to information security protocols such as PCI DSS (Payment Card Industry Data Security Standard).

Related post:

What do I need: A payment gateway, a payment processor, or both?

Your business type and offered payment options will determine if you need a payment gateway, a payment processor, or both.

If you have an omnichannel business or global operations, you should invest in payment processing platforms for smooth, secure, and consistent transactions across channels and currencies. Moreover, when you process a high volume of transactions every day, you’ll need a payment processor to minimize errors and automatically generate reports for reconciliation.

If you have online stores, process phone or mail orders, offer subscription services, or don’t have a complete POS system, you’ll need a payment gateway to securely process payments and manage recurring charges.

Note that a payment gateway needs to work with a payment processor. Many payment processing companies, such as Adyen, PayPal, and Stripe, offer end-to-end card processing services including both the payment gateway and payment processor. For brick-and-mortar businesses, your payment gateway might be built into your POS hardware.

If you process eCommerce transactions or accept card payments without a full POS system, you’ll need both online payment processors vs payment gateways to ensure secure and efficient transactions.

FAQ

1. Can a payment gateway be a payment processor?

No, payment gateways vs payment processors are distinct components of the transaction process. Payment gateways step in first to encrypt and transfer payment information to the payment processor. Payment processors then verify the card information and facilitate the fund transfer.

However, some payment service providers offer end-to-end payment solutions, including both a secure payment processor and a payment gateway under one brand name, such as Adyen, Stripe, and PayPal.

2. Are Amazon Pay, PayPal, Authorize.net, Stripe, Square, Worldpay, and Visa payment gateways or payment processors?

Some of them are either a payment gateway or a payment processor while others are both. Let’s see the summary below.

Payment gateway | Payment processor | |

Amazon Pay | ||

Authorize.net | ||

PayPal | ||

Stripe | ||

Square | ||

Worldpay |

Visa is neither a payment gateway nor a payment processor. It’s a card network that provides a communication system between issuing banks and businesses to process credit card transactions.

3. What is the difference between a payment gateway and a POS?

A POS consists of hardware, software, and payment services that help businesses accept payments and complete sales. POS systems can be physical devices in brick-and-mortar stores, or checkout points in online stores.

While point of sale processing includes logging purchased items, processing payments, and generating receipts, payment gateways receive payment information from the POS and send it to payment processors for verification. When processing an electronic trans

4. What are the differences between these terms?

Payment gateway vs payment aggregator

A payment gateway is a technology that allows merchants to securely transfer funds by collecting, encrypting, and verifying customer payment information.

A payment aggregator is a financial organization that consolidates multiple merchant accounts and payment gateways into a single setup. It allows merchants to eliminate the need for individual contracts with acquiring banks, thereby accepting payments more conveniently.

Payment facilitator vs payment processor

A payment facilitator (payfac) provides merchant services. It contracts with a merchant acquirer for payment acceptance on behalf of their merchants, also known as sub-merchants.

Payment processors allow merchants to start accepting payments and route transactions through banks and card networks.

Merchant acquirer vs payment processor

In the payment flow, the transaction data reaches the payment processor first and then travels to the merchant acquirer.

Specifically, a payment processor authorizes and securely transfers transaction data to the merchant acquirer.

A merchant acquirer (also an acquirer or acquiring bank) receives the payment information from the payment processor, authorizes the transaction with the issuing bank, and facilitates the settlement of funds. It also manages merchant accounts and allows merchants to process payments securely and quickly.

Money transmitter vs payment processor

Purpose: Money transmitters serve individuals and businesses who want to send money overseas or to individuals without access to traditional banking services. On the other hand, payment processors serve a wide range of users, including online businesses, retailers, service providers, etc.

Regulation compliance: Payment processors adhere to PCI compliances to ensure security standards. Money transmitters have to comply with stricter and more extensive regulations due to higher risks of illegal activities.

Payment method: Money transmitters typically accept cash or bank transfers, while payment processors accept various payment options such as credit and debit cards, bank transfers, and e-wallets.

Transaction fee and limit: Money transmitters often have lower transaction limits, while payment processors offer lower transaction fees.

Payment gateway vs payment processor vs merchant account

A payment gateway encrypts customer information and transmits it for authorization.

A payment processor receives transaction details from a payment gateway, authorizes, and processes transactions.

A merchant account holds funds from customer transactions for payment verification before transferring them to the business bank account.

Card network vs payment processor

The payment processor sends the transaction data to the acquiring bank, which transmits it to the card network.

The card network then directs the transaction to the issuing bank for authorization and relays the authorization response to the acquiring bank.

Payfac vs merchant acquirer

A merchant acquirer, or an acquiring bank, contracts with merchants to accept and process payments.

A payfac, short for payment facilitator, contracts with a merchant acquirer to accept payments on behalf of their merchants, also known as sub-merchants.